Discovering the best motor trade insurance can feel like a daunting task, especially when you're trying to weigh quality coverage with cost-effectiveness. As a motor trader, whether you are engaged in buying and trading vehicles or running a garage, having the right insurance is essential for safeguarding your business. Fortunately, with the rise of online insurance platforms, accessing cheap motor trade insurance quotes has never been easier.

In this article, we'll explore effective strategies for finding cheap traders policies that fit your particular needs. Knowing your options and knowing where to look can save you both time and money, allowing you to concentrate on what you do best—running your motor trade business. Let's dive into the world of motor trade insurance and find the most advantageous deals available online.

Comprehending Cheap Motor Trade Insurance

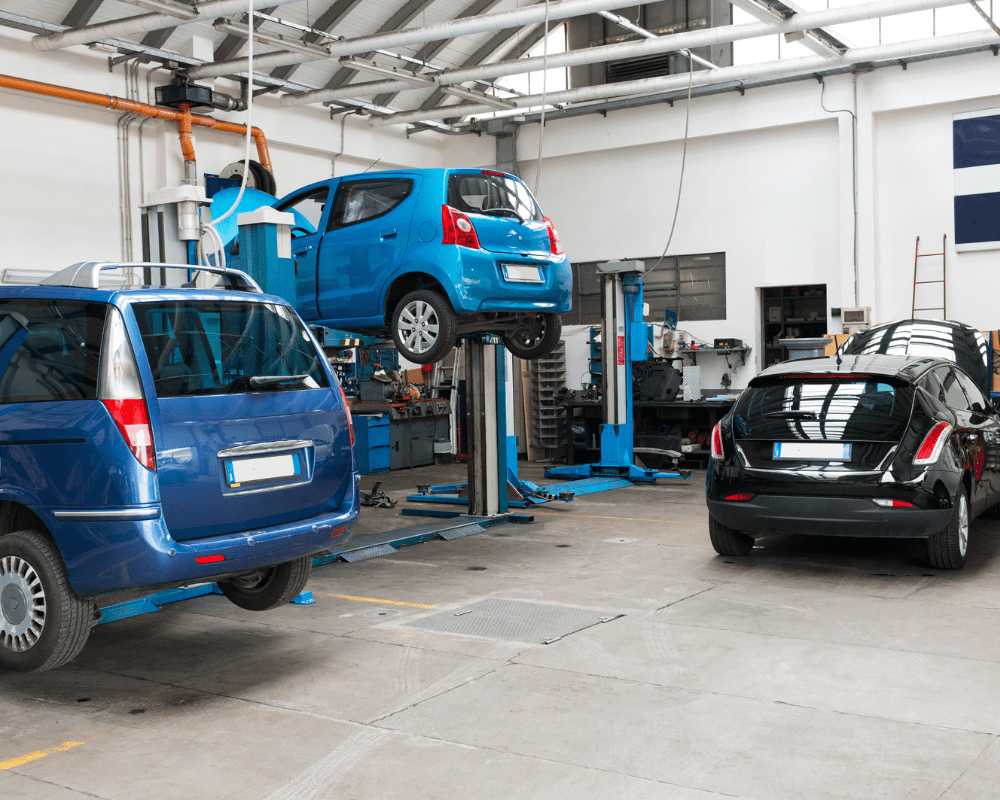

Low-cost motor business insurance is crucial for those in the motor business sector, whether you are a retailer, technician, or any type of merchant handling with cars. This coverage delivers coverage for your commercial functions, safeguarding you against potential damages from mishaps, stealing, or damage to the autos you handle. By understanding the different types of coverage offered, you can more effectively assess what meets your requirements while maintaining expenses down.

When looking for cheap trading policies, it is crucial to contrast different insurance providers and the protection they extend. Some providers may provide more comprehensive coverage at a fair rate, while others may focus on basic coverage. Knowing the specific hazards connected in your commerce can help you find a policy that strikes the ideal harmony between cost and coverage, guaranteeing you are adequately covered while avoiding overspending.

In addition, leveraging benefit of internet resources can simplify the process of finding low-cost motor commerce coverage estimates. Many sites enable you to submit your details and obtain several estimates from various providers in just a small seconds. This handiness not only conserves time but also enables you to make informed decisions that can contribute to considerable cuts on your coverage premiums.

Aspects Affecting Insurance Quotes

Many elements make a significant role in determining the premiums for motor trade insurance. One major factor is the category of vehicles being insured. The age, make, and type of the vehicles in your inventory can influence the overall risk evaluation by the underwriters. Premium vehicles typically come with increased premiums due to their increased chances of being stolen or harm. Additionally, the quantity of vehicles you wish to cover can also impact the rate, with more extensive collections usually able for bulk rates.

An additional key factor is the experience level and claims record of the business owner. Recent businesses could face increased costs versus established individuals who can show a proven track record of safe driving and ethical practices. Insurance providers may also assess the total and aspect of claims made lodged by the individual. Frequent or high-cost claims could result in elevated quotes as they represent a increased exposure to the insurer.

Finally, the locational position of the motor trade business significantly influences insurance quotes. Regions with higher crime rates or heavy traffic may lead to higher quotes. On the contrarily, areas known for reduced rates of incidents or criminal activity might offer more favorable terms. By recognizing these elements, operators can better navigate the field for affordable traders policies and improve their likelihood of finding reasonable insurance solutions.

Tips for Securing the Best Deals

For the purpose of secure the best deals on cheap traders policies , it’s essential to gather multiple quotes from various providers. Take advantage of online comparison tools that permit you to input your information once and receive several offers. This method not only saves time but also helps you recognize the differences in coverage and premiums offered by different insurers. Keep an eye out for unique discounts or promotions, as a few companies may have limited-time offers for new customers.

Another efficient strategy is to combine your motor trade insurance with other types of coverage you may need, such as public liability or employers liability insurance. Many insurers offer package deals, which can significantly reduce your overall premium. Additionally, ensuring a good driving record and keeping claims to a minimum can help you qualify for lower rates. Always ask your insurer if there are any discounts you might be eligible for, as it’s not uncommon for providers to have offers that are not widely advertised.

Finally, consider increasing your deductible if you feel comfortable doing so. A higher deductible generally leads to lower premiums, but it’s important to weigh this option based on your financial situation and risk tolerance. Always read the policy details thoroughly to understand the level of coverage you are receiving. By being proactive and informed, you can find cheap motor trade insurance quotes that best suit your business needs and budget.